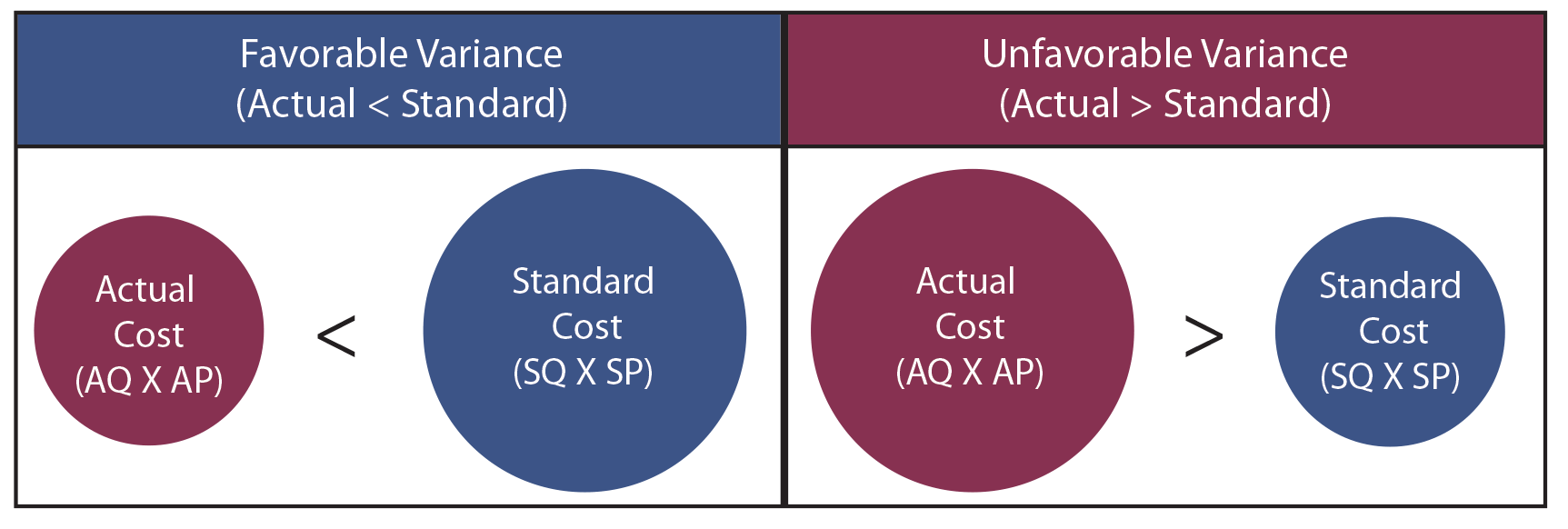

Explain the Difference Between a Favorable and an Unfavorable Variance

Unfavorable variances refer to instances when costs are higher than your budget estimated they would be. Favorable variances are defined as either generating more revenue than expected or incurring fewer costs than expected.

Variance Analysis Principlesofaccounting Com

An unfavorable budget variance describes negative variance indicating losses or shortfalls.

. Therefore when actual revenues exceed budgeted amounts the resulting variance is favorable. Favorable variances mean youre doing better in an area of your business than anticipated. Budget variances occur because forecasters are unable to predict future.

Variance is the difference between the budgetedplanned costs and the actual costs incurred. Unfavorable variances are the opposite. The variance is unfavorable because the company took more time than budgeted to produce the.

Flexible Budgets and Standard Cost Systems Page 1 of 78. 4 - Factory Overhead Variances use different volumes explain the differences and where is it used. Favorable variances are defined as either generating more revenue than expected or incurring fewer costs than expected.

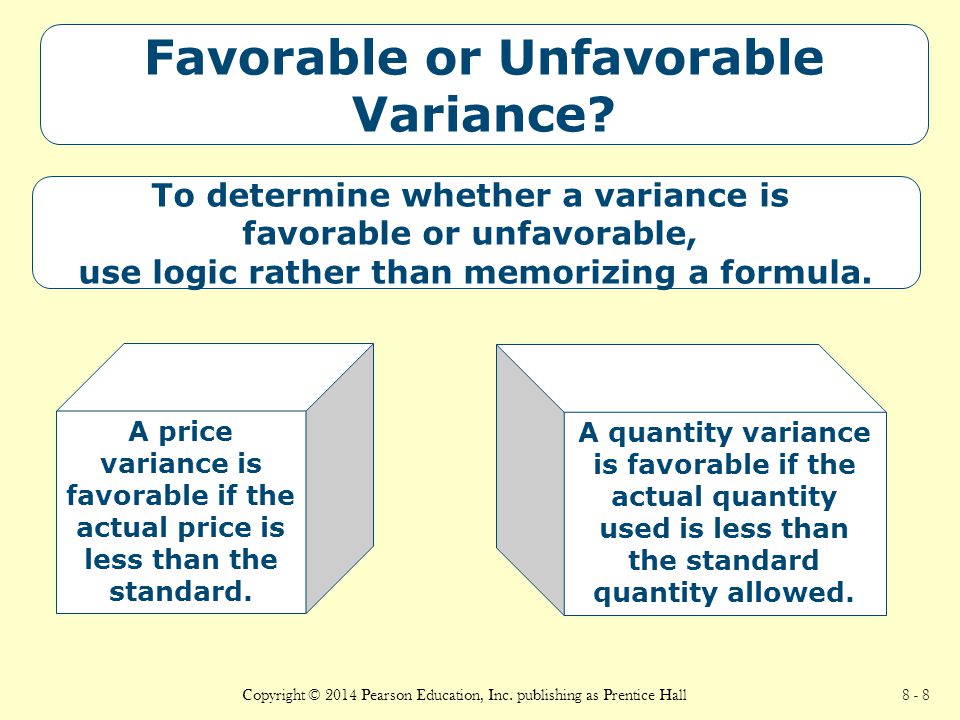

Either may be good or bad as these variances are. A variance can be favorable or unfavorable. Basically whenever you predict something youre bound to have either a favorable or unfavorable variance.

Either may be good or bad as these variances are. And it is unfavorable if the actual cost is more than the budgeted cost. Obtaining a favorable variance or for that matter an unfavorable variance does not necessarily mean much since it is based upon a budgeted or standard amount that may not be an indicator of good performance.

An unfavorable variance is the opposite of a favorable variance where actual costs are less than standard costs. For example if actual revenue is less than budgeted revenue or if actual expense is greater than budgeted. When actual revenues fall short of budgeted amounts the variance is unfavorable.

The 200 difference is the cost variance. A favorable budget variance refers to positive variances or gains. A variance is usually considered favorable if it improves net income and unfavorable if it decreases income.

Explain the difference between a favorable and an unfavorable variance 3. In this case the unfavorable variable overhead efficiency variance is 2200 2000 x 20 4000. How do flexible budgets differ from static budgets.

Give the formula to find each. Favorable variances are defined as either generating more revenue than expected or incurring fewer costs than expected. Unfavorable variances are the opposite.

An unfavorable budget variance describes negative variance indicating losses or shortfalls. What is the key difference between a joint operation and a joint venture. It is favorable if the actual cost is less than the estimate.

3 - List the six 6 Manufacturing Cost Variances. 2 - Define and explain the differences give an example of each between. A favorable unfavorable fixed overhead volume variance indicates that total fixed overhead cost was overallocated underallocated to units manufactured.

Click to see full answer. A favorable unfavorable fixed overhead volume variance indicates that total fixed overhead cost allocated to units manufactured was greater less than the total budgeted fixed overhead cost. Budget variance is the difference between expenses and revenue in your financial budget and the actual costs.

A favorable budget variance refers to positive variances or gains. Up to 256 cash back To see this consider that. All variance accounts areclosed at the end of each period temporary accounts A favorablecost variance is always a credit balance An unfavorable costvariance is always a debit balance Write a one page memorandum toyour instructor with three parts that answers the three followingrequirements.

What is a static budget performance report. Rising costs for direct materials or inefficient operations within the production facility could be the cause of an unfavorable variance in manufacturing. When revenue is higher than the budget or the actual expenses are less than the budget this is considered a favorable variance.

What is the key difference between a cis- and trans-epigenetic mechanism that In Chapter 5 we considered genomic imprinting of the Igf2 gene in which offspring express the copy of the gene they inherit from their father but not the copy they inherit from their mother. What difference between a favorable variance and an unfavorable variance. A variance is favorable if it increases operating income.

If the variance decreases operating income the variance is unfavorable. Unfavorable variances mean your prediction is better than the actual outcome. Favourable variance is that variance which is good for business while unfavourable variance is bad for business.

Also Know what is the cause of an unfavorable volume variance. Less revenue is generated or more costs incurred. How is a flexible budget used.

Less revenue is generated or more costs incurred. Less revenue is generated or more costs incurred. But due to inflation and shortage of labor the actual labor cost was 700.

Rising costs for direct materials or. For example if actual revenue is greater than budgeted revenue or if actual expense is less than budgeted expense then the variance is favorable. B Unfavorable cost variance.

After the period is over management will compare budgeted figures with actual ones and determine variances. When actual results are better than planned variance is referred to as favourable. An unfavorable variance is the opposite of a favorable variance where actual costs are less than standard costs.

Budget variances occur because forecasters are unable to predict future. You can have variances in your. An unfavorable variance is the opposite of a favorable variance where actual costs are less than standard costs.

If revenues were higher than expected or expenses were lower the variance is favorable. Unfavorable variances are the opposite. For example Company A expects the labor cost for next year to be 500.

A Favorable cost variance. What is a variance. During the budgeting process a company does its best to estimate the sales revenues and expenses it will incur during the upcoming accounting period.

If results are worse than expected variance is referred to as adverse or unfavourable.

Determining Which Cost Variances To Investigate Accounting For Managers

No comments for "Explain the Difference Between a Favorable and an Unfavorable Variance"

Post a Comment